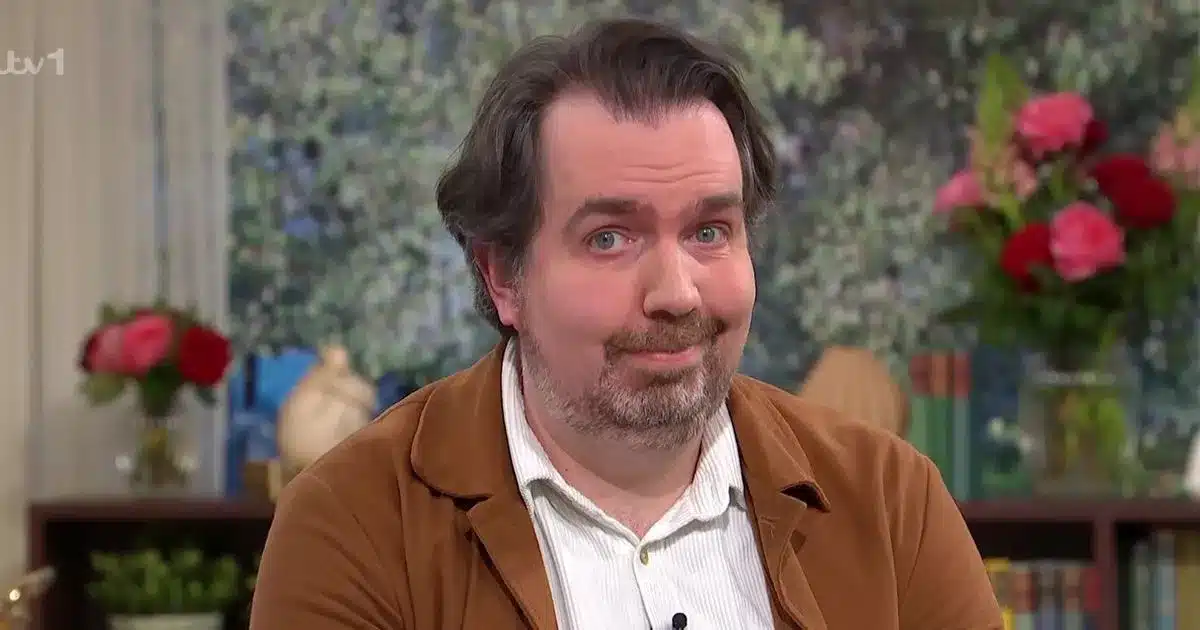

An Aussie bartender who became an overnight millionaire after he found a cash machine glitch splashed £1 million on jets, escorts and holidays, before confessing to his ‘crime’ before anyone had even caught on.

Dan Saunders’ story began on a night out when his card declined at the bar as he was getting a round in for his mates. He took a trip to the nearest cashpoint and found he had just £3 to his name, but decided to withdraw £100 in credit anyway because YOLO, I guess.

Despite the transaction being cancelled by the bank… the cash still magically appeared.

Dan describes the feeling in that moment as ‘discovering fire’, and realised the glitch occured at the same ATM between midnight and 1AM every night – meaning he could withdraw as much as he wanted in that time without being charged.

Over the next 4 months, he withdrew a total over £1 million and took trips on private jets, drank the finest high-end booze, and banged the fittest escorts money could buy. At one point, he blew £50,000 on a trip to an island off the coast of Bali, during which he hired a private jet to bring his buddies along too.

Dan says: “I opened the book on anything – people just gave me their dreams and I fulfilled them.”

Eventually, Dan decided to do the ‘right thing’ and came clean to the bank, confessing what he’d done. The bank then told the police who took so long to do anything about it that anxious Dan decided to do a whole media tour about it, which eventually led to his arrest.

The judge and prosecutor had no idea what he’d actually done and after pleading guilty he ended up getting one year in jail with eighteen months community service. Worth it?

Dan says: “The court case was weird because no one actually understood what I did: not the judge, not the prosecutor, it was very odd. There were many blank looks; the bank provided minimal evidence so it was really just a case of ‘bad Dan and that’s it… case closed.

In a statement, National Australia Bank told LADbible: “Once the fraudulent transactions were confirmed in May 2011, NAB took immediate action to close the relevant accounts and prevent any further fraudulent transactions by the individual.

“NAB also ensured a similar fraud could not be carried out by any other individual.”

All’s well that ends well eh?